Direct measurement of driving behavior, the heart of usage-based insurance (UBI), is the best way to match risk to premium. Insurers offer insurance discounts to safe drivers via UBI in order to acquire and retain the best risks. As a result, safer driving is promoted among these customers, which can amount to savings for organizations insuring drivers.

UBI is among the first attempts by insurers to adopt state-of-the-art technology for the underwriting process. Insurance companies and other service providers have struggled with some essential questions including those about the kind, resolution, frequency, and duration of data to collect, as well as what sensors to use. Indeed, many companies underwent independent efforts to establish data collection methodologies, generally resulting in a lack of any industry standard data “dictionary” or shared methodology for UBI. Still, it is possible to identify common approaches to collecting UBI data and how they are likely to evolve in the future.

Since the initial trials of UBI, the three cost factors—hardware, data, and analytics—have been the primary considerations as to how and what data elements each company collects. And even though prices of all three generally continue to decrease, the typical cost of setting up a full UBI program with filed predictive models remains significant.

buy clomid online https://galenapharm.com/pharmacy/clomid.html no prescription

In the absence of industry-wide standards, it can be difficult to outline the breadth of the types of data collected. Even so, the following list covers most of the UBI data types found in the auto insurance market:

Verified mileage: This most basic mean of UBI is based on the well-validated assumption that more driving means more exposure to risk. Still, the advantage of verified mileage over declared mileage alone usually doesn’t justify a UBI operation for many companies.

Trip timing: A small advancement over verified mileage is trip timing. This goes beyond the pure mileage factor to estimate risk by studying when a driver is on the road, on the premise that some time slots tend to be riskier than others (Friday night, for example, with associated risk characteristics such as fatigue or drunk driving).

Driving events: Basic, yet powerful, behavioral aspects of driving are measured through collection of driving event data, mostly braking, accelerating, and turning. Sometimes absolute speeding events (exceeding 80 mph) and relative speeding events over the posted speed limit are recorded. Note, however, that onboard telematics units have relatively limited accuracy in collecting such data.

Full data log: As dongles came to market, they introduced improved collection capabilities, such as advanced GPS modules, CPU, accelerometers, OBDII, and large storage. With the falling cost of mobile data, companies started collecting full data logs and compressed them on dongles. Full data logs may provide endless analytics opportunities.

Smartphone data: The first technology to break the cost paradigm centering on device, data, and analytics is that operating from smartphones. Smartphones are also smart telematics devices owned by many, offering great collection and storage capabilities and data transfer at practically no additional cost. Unfortunately, smartphone data introduces many analytic challenges, including not knowing whether an insured is a driver or a passenger, whether the phone is turned off, and whether a driver operates an insured car.

What should we expect in the future? Against the background of rapidly changing technology and growing analytic complexity, future UBI is likely to rely on some of the following data elements:

Mobile data: As mobile apps become more sophisticated and reliable and as phone sensors become more accurate, more insurers are likely to use data obtained from mobile apps as a low-cost solution.

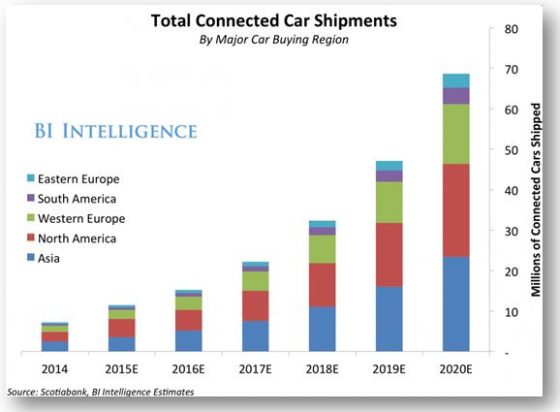

OEM data: Connected cars are growing in number (Gartner forecasts that by 2020, some 250 million cars will be connected). Data sets collected by connected cars aren’t as rich as those collected by dongles and provide more basic attributes (such as verified mileage, trip timing, and driving events). Nevertheless, they allow insurers to consume data more easily through data exchanges, where original equipment manufacturers (OEMs) take responsibility for the data collection process.

Clearly, OEM capabilities will probably become even more advanced as manufacturers see more value from their investment.

Distribution of projected connected cars (source Business Insider)

Distribution of projected connected cars (source Business Insider)

Advanced Driver Assistance Systems (ADAS) data: ADAS can provide driving alerts and override driver inputs in certain situations. To date, these devices haven’t become part of the UBI ecosystem but can potentially contribute tremendous value to analytics for driving behavior and may play a significant role in the future.

A final question about autonomous cars: Will they render UBI obsolete? Probably not, and for two reasons.

First, penetration of autonomous cars and shared vehicles may well be slow and gradual. Second, many events currently measured by UBI will probably remain important when autonomous driving is used (for example, time and destination of journeys). UBI is likely here to stay.

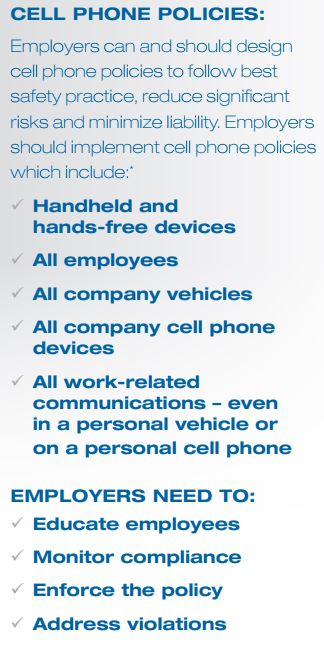

Employers can and are being held liable for damages resulting from employee accidents. “We might expect an employer to be held liable for a crash involving a commercial driver’s license holder who was talking on a cell phone with dispatch about a work-related run at the time of an incident—especially if the employer had processes or a workplace culture that made drivers feel compelled to use cell phones while driving,” the NSC said.

Employers can and are being held liable for damages resulting from employee accidents. “We might expect an employer to be held liable for a crash involving a commercial driver’s license holder who was talking on a cell phone with dispatch about a work-related run at the time of an incident—especially if the employer had processes or a workplace culture that made drivers feel compelled to use cell phones while driving,” the NSC said. blurred in some cases involving:

blurred in some cases involving:

As organizations’ exposures increase in number, complexity and severity, shareholder funds generated by captives are becoming more important. According to Marsh:

As organizations’ exposures increase in number, complexity and severity, shareholder funds generated by captives are becoming more important. According to Marsh: “We expect to see a continued increase, driven in part by companies that are already strong captive users and by those that may have difficulty insuring their professional liability risks,” Marsh said.

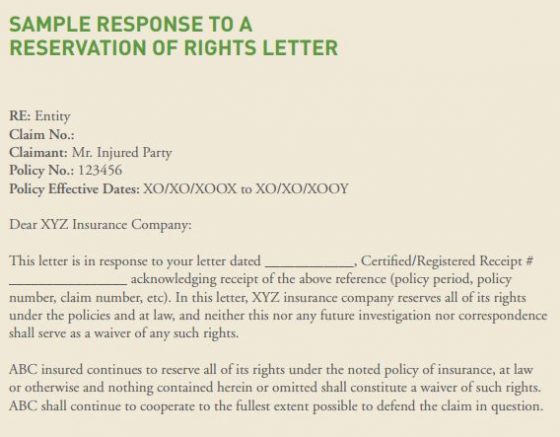

“We expect to see a continued increase, driven in part by companies that are already strong captive users and by those that may have difficulty insuring their professional liability risks,” Marsh said. In some cases, a well thought-out response can save an organization a large amount of money. A good example is the common insurer-proposed reservation to recover defense costs spent on defending a policyholder if the insurer determines at a later date that it did not, in fact, have a responsibility to defend. In order to reject this reservation and the big legal bills that could come with it down the road, many jurisdictions in the United States require that the insured respond to the reservation of rights letter and specifically disagree with this detail.

In some cases, a well thought-out response can save an organization a large amount of money. A good example is the common insurer-proposed reservation to recover defense costs spent on defending a policyholder if the insurer determines at a later date that it did not, in fact, have a responsibility to defend. In order to reject this reservation and the big legal bills that could come with it down the road, many jurisdictions in the United States require that the insured respond to the reservation of rights letter and specifically disagree with this detail.