Last week officials in Harris County, Texas were granted permission to file a lawsuit against international chemical company, Arkema, Inc., in attempt to recover the costs of responding to the crisis at the company’s plant in Crosby during Hurricane Harvey in August into September. The County has asked a court to review the plant’s environmental practices and disaster preparedness plan and to determine how, if at all, it was updated to reflect the projections of 50-plus inches of rain in the days leading up to Harvey’s landfall.

The New York Times reported that in its risk management plan to the federal government, Arkema indicated that floods and hurricanes, as well as power failure and loss of cooling, were threats to its Crosby chemical plant. In its filing with the government, however, Arkema did not provide contingency plans to address those concerns, the Times said.

As previously reported, several feet of floodwaters caused a power outage which subsequently prevented Arkema plant staff from ensuring that nearly 500,000 pounds of organic peroxides were kept cooled and stable. The chemicals eventually overheated and caused a series of explosions which started in late August into the first week of September. This led to a mandatory 1.5-mile evacuation of the area, affecting about 300 homes and many nearby businesses.

Local media reported that Harris County Attorney Vince Ryan is expected to file the lawsuit this week. “The company’s lack of preparedness caused a crisis on top of this horrific storm,” Ryan said in a statement.

“Dozens of first responders were required by this emergency caused by Arkema when their services were desperately needed elsewhere.

”

According to the County’s statement:

Investigations conducted by the Harris County Pollution Control Services and the Harris County Fire Marshal’s Office uncovered serious violations of the Texas Clean Air Act. Ryan will seek to recover the County’s costs for responding to the week-long incident.

This is the second suit to arise from the Arkema plant’s explosions. On Sept. 7, seven first responders filed a negligence lawsuit against Arkema, alleging they were not warned of the smoke and fumes and their effects prior to arriving. The responders claim they became ill shortly after they began working on the scene following the Aug. 31 explosion; many left vomiting, gasping for air and unable to breathe during and after rescue efforts.

The Texas Tribune reported that the lawsuit was updated in late September, swelling to include six additional first responders and a number of area homeowners. They claim to have suffered “upper respiratory infections, bronchitis, pneumonia, itchy, burning eyes, tight, burning throats and the like—illnesses and injuries that did not exist prior to the explosions and fires at the Arkema facility and illnesses resulting from and exacerbated by the explosions and fire at the Arkema facility.” Plaintiffs are seeking more than million in damages, according to the suit.

The third lawsuit was filed Oct. 2 by nearby residents who claim their properties were contaminated with toxins. The federal suit details how residents are now suffering from medical problems ranging from scaling and rashes to respiratory problems.

“Based on testing results received to date, Arkema has not detected chemicals in off-site ash, soil, surface or drinking water samples that exceeded Residential Protective Concentration Levels established by TCEQ for soil and groundwater,” company spokesperson Janet Smith said in an email to Houston Public Media.

Harris County’s full statement can be found here.

coverage argument under the law.”

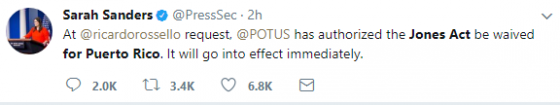

coverage argument under the law.” Maria wiped out power on the island and destroyed infrastructure and cell towers, leading to massive shortages. Even though a waiver had been granted to Texas and Florida after Hurricanes Harvey and Irma, the Department of Homeland Security initially said there was no need to waive the restriction for Puerto Rico, as it would not address the issue of the island’s damaged ports.

Maria wiped out power on the island and destroyed infrastructure and cell towers, leading to massive shortages. Even though a waiver had been granted to Texas and Florida after Hurricanes Harvey and Irma, the Department of Homeland Security initially said there was no need to waive the restriction for Puerto Rico, as it would not address the issue of the island’s damaged ports.