Whether a government subpoena constitutes a “claim” is a frequently contested issue between D&O insurers and their policyholders. D&O policies—at least with respect to coverage for private companies and individual insureds at any company—typically define “claim” through multiple subparagraphs: first, a broad and generalized subparagraph that usually references a “written demand for monetary or non-monetary relief,” followed by several narrowly framed subparagraphs that address more specific situations, such as “a civil or criminal proceeding commenced by the service of a complaint or similar pleading.” Most courts have held that generalized language, such as any “written demand for . . . non-monetary relief,” must be read expansively to encompass government subpoenas.

Insurers trying to avoid covering costs incurred by policyholders in connection with government subpoenas sometimes respond to these decisions by arguing that the generalized subparagraph should not be read broadly if one or more subsequent specific subparagraphs reference government subpoenas (or government investigations). For instance, an insurer may argue that a subparagraph expressly providing coverage for government subpoenas issued to individuals implicitly narrows the meaning of “written demand for . . . non-monetary relief” to foreclose coverage for government subpoenas issued to corporate entities. Similarly, an insurer might contend that a subparagraph explicitly providing coverage for subpoenas issued by the Securities and Exchange Commission implicitly narrows the meaning the meaning of “written demand for. . . non-monetary relief” to preclude coverage for subpoenas issued by other government agencies. Policyholders should be prepared to reject such arguments, as they ignore both well-established law regarding the interpretation of insurance policies (which prohibits insurers from limiting coverage by implication) and the typical structure of D&O policies (which contemplates that the subparagraphs defining “claim” will complement, not limit, each other).

First, it is well settled that provisions in an insurance policy setting forth the scope of coverage must be understood in their most expansive and inclusive sense for the policyholder’s benefit, while language that would limit coverage must be narrowly and strictly construed against the insurer (especially where that language would negate coverage provided elsewhere in the policy). Additionally, courts and commentators agree that any limitations on coverage must be stated in clear and unmistakable terms and cannot be extended by implication. Further, to the extent that there are any ambiguities in a policy’s terms, those ambiguities must be resolved in favor of coverage. Given these rules of construction, insurers have no basis to argue that a specific subparagraph in the definition of “claim” implicitly removes coverage that would otherwise be available under the generalized subparagraph.

Second, the multiple subparagraphs defining “claim” are intended to supplement, not restrict, each other. Insurance policies are often drafted with what courts have referred to as a “belts and suspenders” approach, and the definition of “claim” in D&O policies is one such example, where the generalized subparagraph is the belt ensuring coverage for a broad range of losses, whether or not they are enumerated in the specific subparagraphs, and the specific subparagraphs are the suspenders providing additional certainty on issues of particular importance to a policyholder. This additive approach to defining “claim” is also mandated by the use of the connector “or” between subparagraphs, a word that courts have consistently held requires that each of the connected provisions be given separate meanings that do not modify each other. This reading is also consistent with the many court decisions holding that a “written demand for . . . non-monetary relief” includes government subpoenas, as those courts reached their rulings despite the presence of multiple specific subparagraphs in those policies’ definitions of “claim.”

For these reasons, policyholders faced with an insurer attempting to deny or restrict coverage for government subpoenas by implication should be prepared to respond forcefully and push for coverage under the broad and generalized subparagraph that promises coverage for any “written demand for monetary or non-monetary relief.”

Across the vast geography of the United States, flood is no stranger to any of the states. From the March 2018 Nor’Easters that slammed the East Coast to the numerous storms and hurricanes that have swept across the country, both coastal and non-coastal regions are all at risk of flood.

Across the vast geography of the United States, flood is no stranger to any of the states. From the March 2018 Nor’Easters that slammed the East Coast to the numerous storms and hurricanes that have swept across the country, both coastal and non-coastal regions are all at risk of flood.

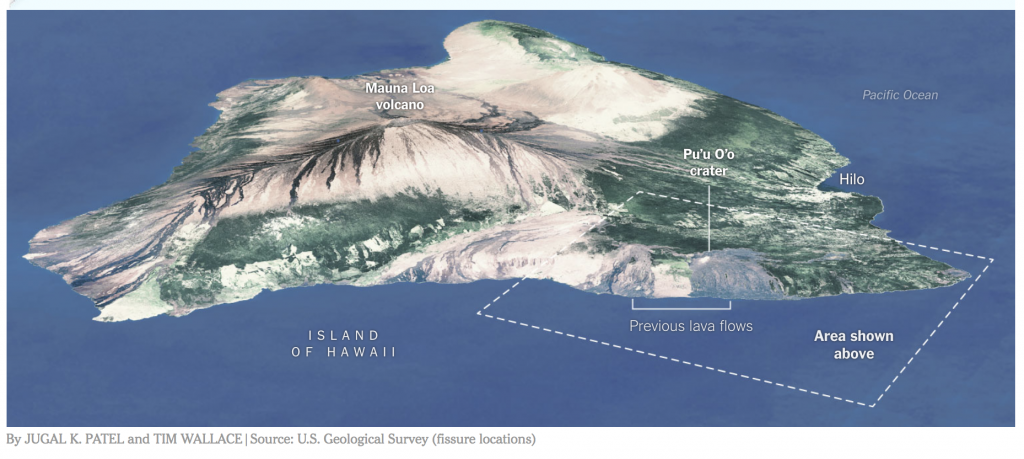

Volcanic activity from the Kilauea eruption in Hawaii has lessened, although aftershocks, lava flow and hazardous fumes continue in some areas, the Hawaii Volcano Observatory reported yesterday. Aftershocks from Friday’s magnitude-6.9 earthquake also continue, with more expected, including larger aftershocks potentially producing rockfalls and associated ash clouds, according to the United States Geological Survey.

Volcanic activity from the Kilauea eruption in Hawaii has lessened, although aftershocks, lava flow and hazardous fumes continue in some areas, the Hawaii Volcano Observatory reported yesterday. Aftershocks from Friday’s magnitude-6.9 earthquake also continue, with more expected, including larger aftershocks potentially producing rockfalls and associated ash clouds, according to the United States Geological Survey.