Until recently, a global pandemic was, in most people’s minds, little more than a compelling plot to blockbuster films and apocalyptic science-fiction stories. A disease drastically changing the way of life and business operations for people across the globe and inciting wide-spread fear, quarantines and stay-at-home regulations was unthinkable for most beyond the “prepper” community. Now, though, after weeks of lives overturned, hindsight is 20/20 (pun intended). Many business owners and executive teams now agree the threat was obvious. A black swan.

As popularized by finance professor and Wall Street trader Nassim Nicholas Taleb in relation to financial markets, the term “black swan” refers to a rare or low-probability event that deviates from what is normally expected but poses critical threat. The 2008 financial crisis, the 2001 Fukushima nuclear disaster, the 9/11 terrorist attack and the dot-com crash of 2000 are all considered black swan events. We can never know with specificity which particular black swan will come, but we can know with certainty that one eventually will. And, due to their severe consequences, we should therefore consider how to make sure our lives and businesses will be robust against them.

Insurance for Black Swans

Third-party commercial insurance policies often include business interruption coverage. Business interruption insurance protects against losses sustained due to periods of suspended operation. With COVID-19, many businesses considered non-essential have been forced to close and numerous businesses that are still hanging on have experienced challenges to their revenue streams as a result of coronavirus restrictions. This is where this form of insurance comes into play. However, pandemics are not the only black swans that business interruption insurance would cover. It could also cover losses from unexpected events like natural disasters, cybersecurity attacks, terrorist attacks or fallout from climate change. Also, even if a business’s insurance policy does not cover pandemic disease through business interruption, it is possible that other policies might be triggered due to the chain reaction caused by the black swan, such as:

- Supply Chain Interruption

- Loss of Key Customer

- Subcontractor Default

- Property (e.g., loss of access to business premises due to quarantines)

- Catastrophic Risks

However, third-party commercial insurance policies are not always enough. These policies are often riddled with exclusions that prevent coverage during the time it is most needed and can lead to a claim being denied. Commercial insurance for an asymmetrical threat like a black swan event can also be extremely costly or difficult to obtain. And in many cases, coverage is simply unavailable. For example, during the avian flu epidemic, many U.S. insurers added an exclusion to their policies, “Exclusion for Loss Due to Virus or Bacteria” (ISO form COP 01 40 07 06). Similarly, the insurance industry responded to SARS by adding exclusions to preclude coverage for losses triggered by business interruption.

Businesses need to review their insurance policies to identify gaps in coverage. Some may want to consider filling these gaps and strengthening their coverage by supplementing the third-party commercial insurance by pooling their risks in a captive insurance company.

Taking Black Swans Captive

A captive insurance company is a licensed insurance company that is usually owned by a related business or its owner. That company can then insure a wide variety of the related business’s risks—risks likely to be implicated in any black swan event such as supply chain interruption, loss of a key supplier or customer, subcontractor default, bankruptcy of certain counterparties, or losses from governmental actions like forced business suspension or quarantines.

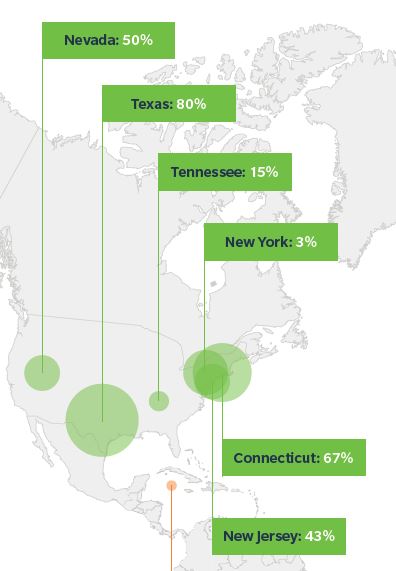

Via reinsurance arrangements, the captive insurance company can then pool its risks with the risks of many unrelated business, usually including those in completely different industries. Some of those businesses and industries will no doubt be the beneficiaries of most any given black swan event.

For example, some physician practices that specialize in elective surgeries have seen their revenues cut by half overnight due to states prohibiting such procedures in order to preserve medical equipment for use by those fighting COVID-19 on the front lines. But other medical practices have seen their revenues skyrocket as COVID-19 has spiked demand for their services. By risk pooling via a captive insurance company, the claims of those practices that are suffering will therefore be paid in part by those that are prospering. This loss-sharing will allow the former to stay in business and continue covering their costs (such as rent and salaries), thereby making the entire economy more robust. And next time around, the proverbial shoes may just be on the other feet. In some cases captive insurance companies may also receive very favorable tax treatment that also provides additional liquidity during times of crisis.

Preparing for the Next Black Swan Event

The coronavirus has heightened awareness of the need for both risk management and strategic planning to prevent future crises from negatively impacting company financials and viability. Sadly, not all businesses will remain healthy and viable through this pandemic, and it is too late for those impacted by the coronavirus to insure those particular losses. But business owners and executives can take immediate steps now to prepare for the next black swan, whatever it may be and whenever it may come.

As organizations’ exposures increase in number, complexity and severity, shareholder funds generated by captives are becoming more important. According to Marsh:

As organizations’ exposures increase in number, complexity and severity, shareholder funds generated by captives are becoming more important. According to Marsh: “We expect to see a continued increase, driven in part by companies that are already strong captive users and by those that may have difficulty insuring their professional liability risks,” Marsh said.

“We expect to see a continued increase, driven in part by companies that are already strong captive users and by those that may have difficulty insuring their professional liability risks,” Marsh said.