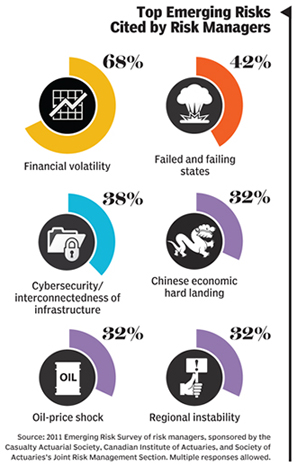

Seeing a chasm between risk perception and risk reality has ceased to surprise me. Virtually every survey, study and report I come across reveals that executives either (a.) don’t understand the risks they take or (b.) understand the risks they take but just opt not to do anything about them.

Well, here is another surprisingly-not-surprising revelation: 80% of public companies think it is unlikely that their directors and officers will be sued. This is despite the fact that, according to the latest “Chubb Public Company Risk Survey,” 23% of companies have already been sued, and the rising risks of more lawsuits in the future due to rising mergers-and-acquisition activity and increasing enforcement actions related to the Foreign Corrupt Practices Act (FCPA).

Let’s look at the latter part first: FCPA.

The Walmart bribery scandal in Mexico has brought this once-dormant law into mainstream focus, but it is the Justice Department’s behavior in recent years that highlights the growing risk for companies. In 2010, DOJ imposed $1.7 billion in fines on companies for FCPA violations/settlements. By contrast, that number was just $2.7 million in 2002.

As a multinational company, you can’t look at these numbers and see anything but a federal priority to stamp out illicit corporate behavior overseas. And that means more risk of fines, lawsuits and settlements that could be even more damaging to a reputation as they are to a bottom line. Insurance may protect against some of this, but not all.

“An FCPA investigation can cost a company millions of dollars, and violators have faced enormous fines,” said Evan Rosenberg, senior vice president and global specialty lines manager for Chubb. “D&O policies can cover directors’ and officers’ defense costs for an alleged FCPA violation and fines for non-willful violations of the act.” (For more on that, here is a good breakdown of all the FCPA insurance issues companies should be aware of.)

Regardless, more than two-thirds of survey respondents (78%) are not worried about an investigation due to an FCPA violation, and 13% have decreased the financial and human resources they devote towards mitigating FCPA-related losses.

The mergers and acquisitions risk is also foolish not to consider.

But … and stop me if you’ve heard this one before … most companies are acting foolishly.

A full 64% of the survey respondents have been involved in a merger, acquisition or restructuring over the past two years. Yet, more than one-quarter of companies (26%) do not have documented merger and acquisition protocols and have no plans to develop them in the next 12 months.

“While M&A-related lawsuits may be covered by the company’s directors and officers liability policy, documented protocols may help improve the company’s defense in court or result in a lower settlement amount,” said Rosenberg.