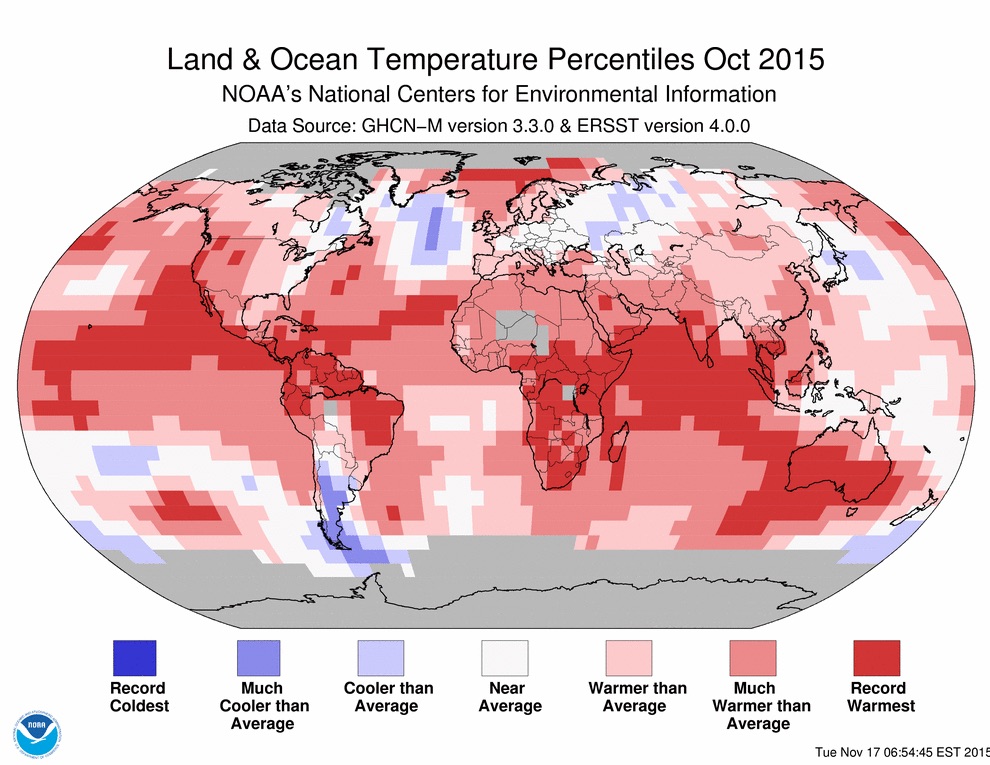

It isn’t just your imagination: October 2015 was the warmest on record worldwide, and saw the greatest above-average deviation for any month. According to the National Oceanic and Atmospheric Administration, the average temperature across global land and ocean surfaces was 1.

76 °F above the 20th century average, surpassing the previous record set last year by 0.36 °F. The globally-averaged land surface temperature was 2.39°F above the 20th century average—the highest for October in 136 years of NOAA records.

October was also the warmest month ever compared to average, out of a total of 1,630 months. What’s more, NOAA reports, eight of the first 10 months of the year have been record warm for their respective months—also a record number of broken records. Globally-averaged land surface and sea surface temperatures have been 1.55 °F and 2.30 °F above average, respectively, surpassing all previous records. With many months setting record high temperatures by unprecedented margins, NOAA said in August that there was a 97% chance that 2015 would secure the title of the warmest year on record, and it remains solidly on track.

In early November, the Met Office, Britain’s national weather service, and NASA both reported that the Earth’s average temperature is likely to rise 1 °C above pre-industrial levels for the first time by the end of 2015. This milestone is significant since it marks the halfway point to two degrees Celsius, the internationally accepted limit for avoiding the worst consequences of climate change, the Washington Post reported. Since 2000, global monthly heat records have been broken 32 times, yet the last time a monthly cold record was set was in 1916, according to CBS News.

Some of the heat is likely due to a strong El Nino event in the Eastern Pacific that continues to gather strength.

This year’s El Nino is already one of the three strongest ever seen, CNN reports, but cannot account for all of the year’s warmth, as 13 of the 15 warmest years on record have occurred since 2000. Rather, it is the combination of long-term warming and the strong El Nino pushing Earth toward its second consecutive warmest year on record.

According to Aon Benfield’s October 2015 Catastrophe Report, there were three billion-dollar weather-related disasters in October: flooding in South Carolina with economic losses of at least $2 billion, $4.2 billion in damage from Typhoon Mujigae in China, and $1 billion in damage from flash flooding in France. The firm estimates worldwide economic losses from October to total more than $10 billion. There have been 21 billion-dollar weather events through October 2015, Aon reported, on pace for a lower total than the annual average of 28.

Check out the infographic below for more of the major climate anomalies and events from October 2015: