It’s a dangerous world for business people, and it is well known that some areas of the world are definitely more dangerous than others.

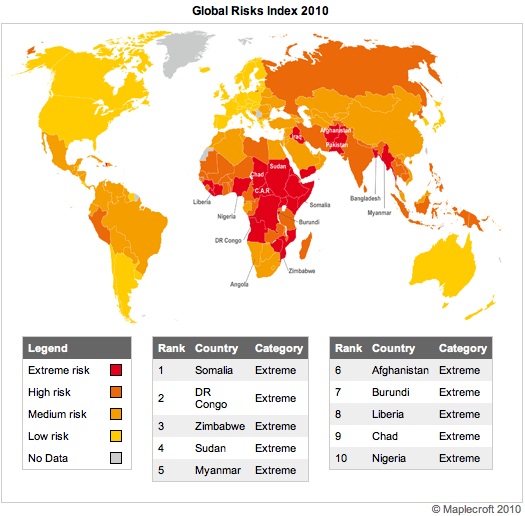

Maplecroft, a risk intelligence organization, has released its analysis of the 175 most dangerous countries for business. Its Global Risks Index (GRI) measures a combination of different risks that have an impact on global operations, supply chains and distribution networks of corporations.

The GRI takes into account the following risks:

- Terrorism

- Conflict

- Macroeconomic Risks

- Rule of Law

- Resource Security

- Vulnerability to climate change

- Natural Disasters

- Human rights violations

- Poverty

- Risks from pandemics and infectious diseases

Without much surprise, Africa takes the cake for being home to the most dangerous countries in which to do business. The top four are:

- Somalia

- DR Congo

- Zimbabwe

- Sudan

Other notably dangerous countries include Afghanistan, Nigeria, Iraq, Bangladesh, Pakistan and Yemen. The report pointed to the most dangerous countries’ weak governance, internal conflicts and regional instability among the reasons It’s also important to note that “several of these countries, including DR Congo, Nigeria, Iraq and Pakistan, are owners of huge oil, gas and mineral reserves, which form important links in the supply chains of western and BRIC companies alike.” The following map indicates regions of risk from low to extreme:

The report also mentions countries that, although not highly ranked as dangerous, are critical to supply chains. Those countries include the Philippines, Indonesia and India.

The United States, Canada and Australia remain low risk.