We heard it in January — reinsurance rates across most lines of the property/casualty business around the world was declining, and according to Guy Carpenter & Company, that decline is continuing.

In the report, “April 1 Reinsurance Renewals: Rates Lower; Returns Under Pressure,” the risk and reinsurance company covers regional developments as well as key issues and trends, which includes:

JAPAN

• Rates at the April 1 renewal showed a declining trend in most classes. Specific changes varied by line of business, and there were occasional exceptions on problematic lines, such as marine hull proportional treaties.

• Total capacity sought by buyers for their major catastrophe exposures was similar to the expiring year, with reductions by some cedents and increases by others.

• The effect of the Chilean earthquake was limited, though it is possible that timing may have played a part, as many of the major placements were quoted, priced and, in some cases, completed before the effects of this loss could be fully realized.

• Overall, the renewal in Japan was smooth and perhaps easier for buyers than in many previous years, reflecting a generally softer market. With few major issues or changes to terms and conditions, renewals were completed within similar timetables as compared to prior years.

US PROPERTY CATASTROPHE

• Pricing for U.S. property catastrophe reinsurance at April 1 saw the continuation of the decreasing pricing trend in evidence at January 1. Capacity continued to be plentiful – a critical element in companies’ ability to secure favorable terms and conditions. Individual renewals vary significantly, based on each company’s own experience and positioning.

• U.S. catastrophe pricing for nationwide companies decreased 8 percent when not factoring in the impact of the catastrophe model changes, and by 13 percent on average when adjusted for these changes.

LATIN AMERICA

• Although not a significant source of April 1 renewals, the Latin American region provides an early indication of the implications of the Chilean earthquake for pricing and terms and conditions. Preliminary estimates of the aggregate loss arising from the earthquake vary widely. The market may continue to evolve going into the July 1 renewals. Overall terms and conditions in the region as a whole appear to be only modestly affected and, in some cases, unchanged by the earthquake. However, pricing varies by country.

REPUBLIC OF KOREA

• In the property catastrophe segment, price changes ranged from decreases of 7.5 percent to increases of 2.5 percent, reflecting the variety of changes and experiences that included increased aggregates, deductibles and, in some cases, limits.

• Korea’s property risk segment was affected by the Samsung loss of late March 2009, which occurred too late to be reflected in the April 1, 2009 renewal. There was a second large loss in November 2009. Both losses were factored into the April 1, 2010 renewal, and loss affected treaties sustained increases of 10 to 15 percent. For loss-free treaties, rates were down by 5 to 10 percent.

• Pricing was down by 10 to 20 percent in the liability market. Loss experience has been light, making the business more attractive to underwriters.

JAPAN

- Rates at the April 1 renewal showed a declining trend in most classes. Specific changes varied by line of business, and there were occasional exceptions on problematic lines, such as marine hull proportional treaties.

- Total capacity sought by buyers for their major catastrophe exposures was similar to the expiring year, with reductions by some cedents and increases by others.

- The effect of the Chilean earthquake was limited, though it is possible that timing may have played a part, as many of the major placements were quoted, priced and, in some cases, completed before the effects of this loss could be fully realized.

US PROPERTY CATASTROPHE

- Pricing for U.S. property catastrophe reinsurance at April 1 saw the continuation of the decreasing pricing trend in evidence at January 1. Capacity continued to be plentiful – a critical element in companies’ ability to secure favorable terms and conditions. Individual renewals vary significantly, based on each company’s own experience and positioning.

- U.S. catastrophe pricing for nationwide companies decreased 8 percent when not factoring in the impact of the catastrophe model changes, and by 13 percent on average when adjusted for these changes.

LATIN AMERICA

- Although not a significant source of April 1 renewals, the Latin American region provides an early indication of the implications of the Chilean earthquake for pricing and terms and conditions. Preliminary estimates of the aggregate loss arising from the earthquake vary widely. The market may continue to evolve going into the July 1 renewals. Overall terms and conditions in the region as a whole appear to be only modestly affected and, in some cases, unchanged by the earthquake. However, pricing varies by country.

REPUBLIC OF KOREA

- In the property catastrophe segment, price changes ranged from decreases of 7.5 percent to increases of 2.5 percent, reflecting the variety of changes and experiences that included increased aggregates, deductibles and, in some cases, limits.

- Korea’s property risk segment was affected by the Samsung loss of late March 2009, which occurred too late to be reflected in the April 1, 2009 renewal. There was a second large loss in November 2009. Both losses were factored into the April 1, 2010 renewal, and loss affected treaties sustained increases of 10 to 15 percent. For loss-free treaties, rates were down by 5 to 10 percent.

- Pricing was down by 10 to 20 percent in the liability market. Loss experience has been light, making the business more attractive to underwriters.

As Chris Klein, global head of business intelligence at Guy Carpenter said, “There are several significant renewals at April 1 in the U.S. that did not show signs of impact from the recent global loss activity. There was some evidence of price tightening in parts of Latin America. The Chile situation remains uncertain, and earthquake losses generally develop more slowly than wind events. Up to half of catastrophe loss ratio budgets were consumed, causing reduced headroom for a larger catastrophe later in the year. This scenario, along with buoyant balance sheets, lower investment yields and thinner reserve releases, will put pressure on returns — sustaining active capital management and perhaps, in time, stabilizing the market.”

We will keep an eye on this potential stabilizing of reinsurance rates for the P/C market — stay tuned.

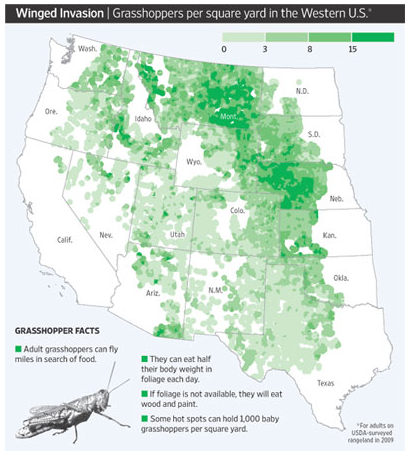

2010 may, unfortunately, become the year of the grasshopper, just as 2005 was the year of the locust. In that year, locusts devastated farms and agricultural businesses from western Africa to eastern Australia, a topic

2010 may, unfortunately, become the year of the grasshopper, just as 2005 was the year of the locust. In that year, locusts devastated farms and agricultural businesses from western Africa to eastern Australia, a topic