As the modern business world becomes more and more sophisticated, so too do the supply chains on which organizations rely. And as these supply chains have become more sophisticated and intertwined, the risk of possible problems has grown.

A recent report by Deloitte states that “Because of the importance of supply chain management to companies’ success, supply chain risk events are having a profound effect and becoming more costly.” The consulting firm surveyed 600 executives at manufacturing and retail companies to understand their perceptions of the causes and affects of supply chain risks. Some of the key findings include:

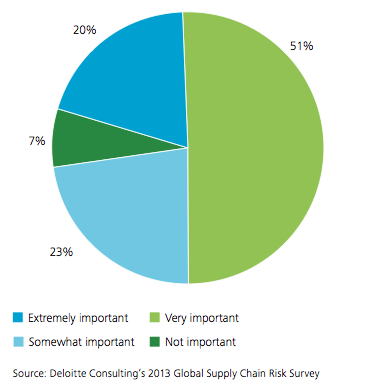

- Supply chain risk is a strategic issue. There are now more risks to the supply chain and risk events are becoming more costly. As a result, 71% of executives said that supply chain risk is important in strategic decision making at their companies.

- Margin erosion and sudden demand changes cause the greatest impacts. The most common and the most costly outcomes of supply chain disruptions are erosion of margins and an inability to keep up with sudden changes in demand, which illustrates the extent to which the supply chain risk issue affects the “heart of the business.”

- Most concern about extended value chain. Executives surveyed are more concerned about risks to their extended value chain—outside suppliers, distributors, and customers—than about risks to company-owned operations and supporting functions.

- Supply chain risk management is not always considered effective. Two thirds of companies have a supply chain risk management program in place, but only half the surveyed executives believed those programs are extremely or very effective.

- Companies face a wide variety of challenges. Executives cited a wide variety of challenges including problems with collaboration, end-to-end visibility, and justifying investment in supply chain risk programs, among others. However, no single challenge stood out, indicating the need for broad approaches.

- Many companies lack the latest tools. Current tools and limited adoption of advanced technologies are often constraining companies’ ability to understand and mitigate today’s evolving supply chain risks.

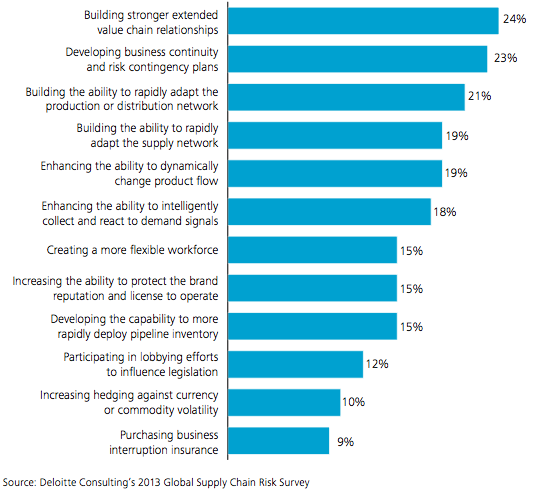

What’s alarming in this report is that even though companies are taking a proactive approach to managing supply chain risks, only about half of the executives surveyed believed their companies are extremely or very effective at managing supply chain risk, including just 13% who considered their companies to be extremely effective. However, when asked which strategies have been most effective, executives most often cited building stronger relationships, building business continuity plans and developing the ability to quickly adapt the production or distribution network.

In all, however, Deloitte’s survey did not reveal the most positive news for companies and how they manage supply chain risk. But if anything, executives can use this information to better understand the weaknesses in today’s supply chain environment. As we’ve seen with past catastrophes and economic troubles, the chain is complex and ever-evolving. Keeping up with changes and eliminating the affect of events is what true supply chain resiliency is.