In this day and age, most every large organization or company has a Facebook or Twitter page (if they’re not living in the dark ages, that is). But just because a company puts itself out there in the world of modern marketing does not mean mayhem won’t ensue.

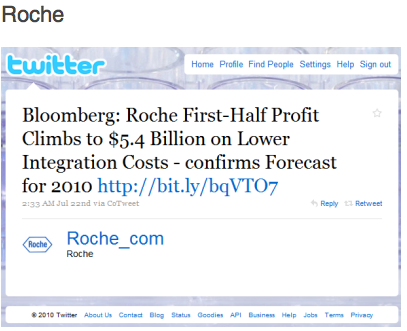

Tweets or Facebook posts on a company’s site can help or harm said company — and it’s a fine line between the two. For this issue, a social media policy should be put in place at any company that plays the social media game. If you want to take it a step further, a community manager should be responsible for all social media outlets that pertain to your brand.

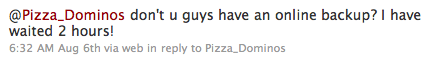

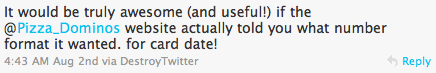

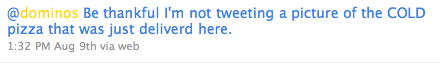

But that’s not all a company has to worry about. As we all know, angry customers often take to the internet to air their grievances, often launching attacks on a company via Twitter or Facebook after a bad experience. Here are a couple of angry tweets aimed at your neighborhood pizza maker, Dominos:

But Dominos, unlike some companies, responds immediately to customer complaints on Twitter. It is obvious that the pizza chain employs several community managers to take care of such issues or forward the complaints on to the appropriate department. This, everyone, is a great example of the right way to use social media.

Another pioneer in the land of corporate social media is Delta.

It was announced today that the commercial airline will now allow users to book flights directly on Facebook.

While it’s commendable that the company is looking to social media to boost sales, Delta is not the first airline to use the social web to reach consumers. Southwest, Virgin and event JetBlue have been communicating deals and information to customers via Twitter and Facebook for some time. I’d expect these airlines to start rolling out a similar sales feature to Ticket Window soon.

online pharmacy rybelsus with best prices today in the USA

Examples of bad business twitter moves include not checking in regularly, mixing business with pleasure (make a separate personal account), mostly self-promotional tweets/posts and not helping others. Having a Twitter or Facebook page that represents your brand means responding quickly and directly and planning for the worst while expecting the best.

What’s the worst case scenario your brand could possibly suffer in a social media PR meltdown? That situation probably won’t occur, but by imagining the worst, you can craft “first line” responses ahead of time, so you won’t be caught off guard. That way you’ll be well prepared if sentiment around your brand suddenly begins to trend negative. This kind of brand take-down, should it occur, happens extremely fast—in a matter of hours.

So, while social media is a great marketing tool for every business, a professional and responsible manager should be in charge of all communication on the various sites and this person should be very well versed on the many risks of social media.