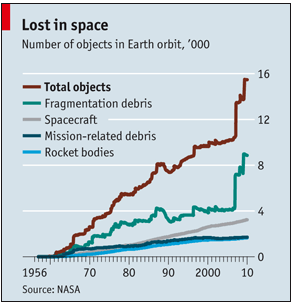

You may remember back in February 2009 when the Iridium 33 and Russia’s Cosmos 2251 satellites collided in orbit somewhere above Siberia. The crash of the two objects resulted in more than 600 pieces of debris larger than a tennis ball being strewn about in space, adding to what scientists and researchers call space debris or space junk.

The problem with the collision of satellites (many of which are non-working and have been abandoned in space to drift freely for eternity) is that it creates added debris in an already cluttered lower earth orbit, creating a hazard to operational satellites. The debris can also pose a threat to space stations — in March of last year, the crew of the international space station was forced to take cover in its escape capsule after learning that a piece of debris moving at 20,000 mph was heading towards them. Though the object missed the space station, it won’t be the last close call.

We covered space risk in our May 2009 issue, stating that scientists are concerned about the “dangerous and possibly irreversible cycle of wreckage.” The worst case scenario for the problem of space debris is known as the Kessler Syndrome (named after NASA scientist Donald J. Kessler), a scenario in which the volume of space debris in lower earth orbit is so high that the risk of further collisions increases to the point where launches become nearly impossible.

A space so cluttered with junk that the U.S. military (or any military for that matter), NASA or any weather, cable or GPS satellites cannot launch? Scary indeed.

The latest issue of the Economist explores the ongoing problem of space pollution, stating that:

At orbital velocity, some eight kilometers a second, even an object a centimeter across could knock a satellite out. According to the European Space Agency, the number of collision alters has doubled in the past decade.

But there are possible solutions to clearing the massive amount of space junk out there. The following are a few ideas put forth in the aforementioned article:

- Use ground-based lasers to change the orbits of pieces by vaporizing their surfaces. Apparently, the American armed forces claim one laser facility could complete the job in a matter of three years.

- Alliant Techsystems has proposed building special satellites enclosed in multiple spheres of strong, lightweight material. Debris that came into contact with the satellite would lose momentum and velocity with each collision. “As a bonus, many object large enough to cause damage would be shattered by the collision into fragments too small to cause serious harm.”

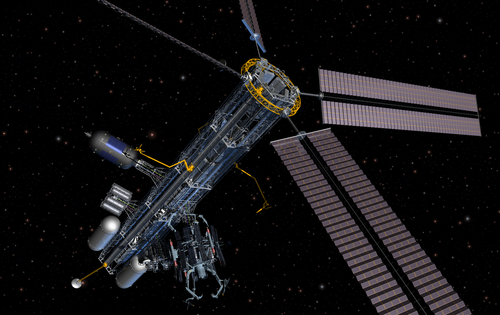

- Robots. That’s right — robots. Many space agencies are considering the option of sending robots into space to dock with dead satellites and fire rockets to either boost them into an uninhabited orbit or deorbit them completely.

Whatever these agencies decide, something should be done quickly to remedy the situation. For every day that passes, more space junk accumulates. Let us not come to realize the dreaded Kessler Syndrome.

From the August 21st - 27th, 2010 issue of the Economist.

Back in May, the European Union’s environmental liability directive was officially put into place, exposing European risk managers to greater liabilities for environmental damage caused by companies that pollute as part of their normal business operations.

Back in May, the European Union’s environmental liability directive was officially put into place, exposing European risk managers to greater liabilities for environmental damage caused by companies that pollute as part of their normal business operations.