The seventh annual National Preparedness Month (NPM) begins today. Launched by FEMA, the month-long awareness program is designed to encourage Americans to prepare for emergencies in their homes, businesses and communities. With that in mind, I took the liberty of contacting Brian Smith with American Express OPEN. He is an expert on commercial risk management and the InsuranceEdge advisor for the company. With a focus on business insurance, I presented him with a few questions. (If you should have any feedback on this Q&A, please feel free to leave a comment.)

What’s the best type of insurance to cover businesses against disasters?

Brian Smith: There are two areas of coverage that must be considered when facing the decision to purchase business insurance: property and business interruption. Property insurance will protect against damage to the physical condition of the business along with the items that sustain operations, such as equipment and fixtures. Property insurance is a mainstay in commercial programs, oftentimes required and rarely overlooked. Business interruption insurance, however, is often undervalued; it is the most critical program needed to sustain operations during a disaster. There are seven points a business owner should consider if questioning the need for business interruption coverage:

- It allows the owner to recoup lost sales and income of the business;

- While the business is down due to the disaster, it will allow the operations to continue during rebuilding;

- Income and profits are protected;

- By staying afloat, the business will be able to retain key clients and contracts;

- Business interruption insurance allows for the employer to keep ALL employees;

- As mentioned, property insurance and business interruption claims are often LARGER than the property loss;

- And finally, the business will likely receive a more rapid and equitable loss settlement on the property claim.

Do different types of companies require different types of insurance and does the business’ location matter in such a decision?

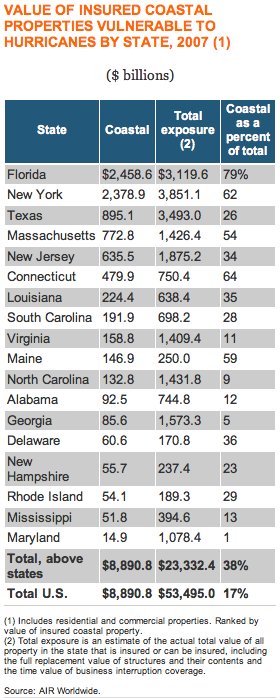

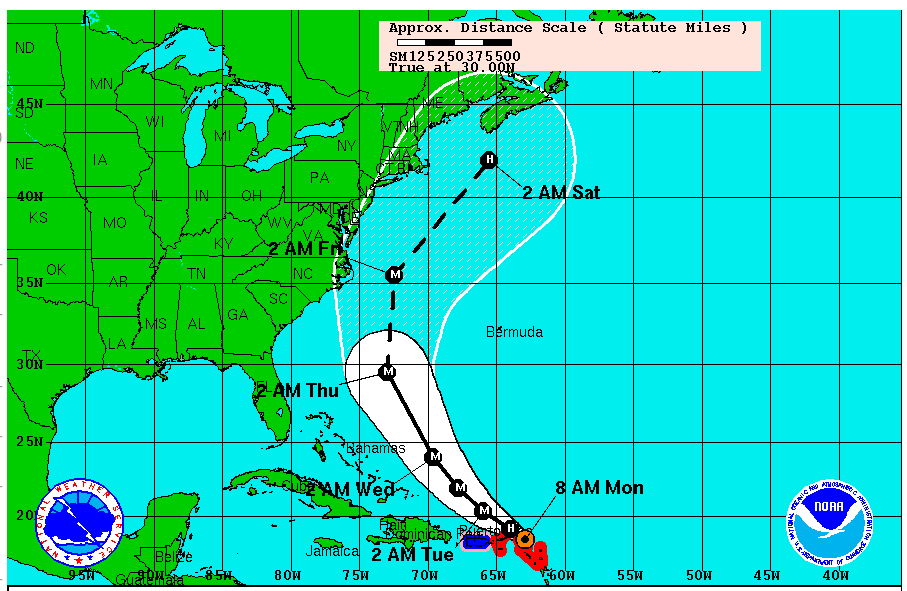

BS: Each company will have its own unique risks associated with it. These must be evaluated by a commercial insurance professional to determine the right coverage for the identified exposures. Taking into consideration the location of a business, however, is one of the key factors. Distance from the coast is one factor, due to exposure to natural disasters such as hurricane and flood. In this case, flood is highly recommended and may be required based on banking terms or contractual needs. An additional type of coverage within the business interruption arena is contingent business interruption. This type of insurance protects the business against a loss due to a dependency on one buyer, supplier, manufacturer or leader property such as in a mall or shopping plaza.

Is now a good time to reassess commercial insurance coverage? If so, why?

BS: The answer here is a resounding YES! Commercial insurance rates are very low at this point. The insurance industry is facing its sixth year of a “soft market,” where insurance companies have lowered rates to unprecedented levels. Insurance program development during this time is highly recommended due to opportunities involving greater coverage, competitive rates and new client demands on both the insurance companies and insurance agencies. Engaging a commercial insurance professional is the best way to see where improvements can and should be made based on operation, location and physical hazards.

Is National Preparedness Month a tool to encourage businesses to analyze their stage of disaster preparedness? How?

BS: I believe it is. The U.S. Department of Homeland Security is shepherding this program at the state and national level. Accompanied by several commercial and personal insurance providers/groups, this national marketing campaign can bring a level of awareness needed for home and business exposures. Coinciding the hurricane season, any awareness program that brings to light what needs to be considered in the event of disaster is always welcome.

What else should businesses know about the importance of being covered from disaster?

BS: Business owners should be aware of the possibility that current insurance programs may be under-estimated or inadequate. A comprehensive review of key items identifying areas of exposure should be considered on an annual basis. Review of current insurance policies is necessary to ensure coverage levels are accurate as well as appropriate. New or changing business operations can have a substantial impact on the monetary needs of a company should it be impacted by a natural disaster. Insuring these exposures properly can only be done if each is understood by the owner and insurance agent and steps are taken to include these values on the current or renewing program.