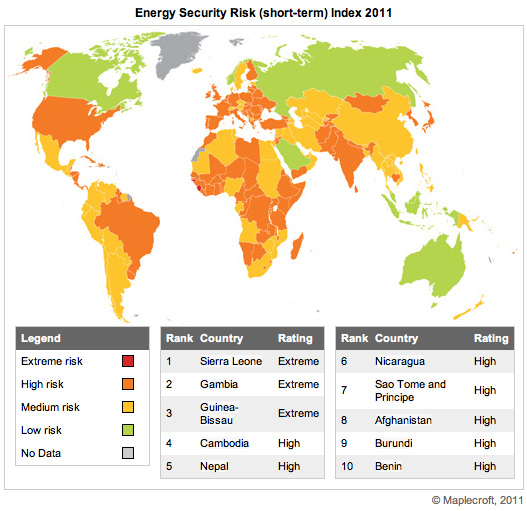

Achieving a stable energy supply in times of political upheaval, overpopulation, dwindling traditional resources and a transition to a low carbon world is downright challenging. And for some countries that challenge seems nearly impossible, according to risk analyst firm Maplecroft, which rated the following countries at “extreme risk” for energy security:

- Sierra Leone

- Gambia

- Guinea-Bissau

The area is commonly known for severe political conflicts, corruption and frequent violence, which further weakens already-fragile communities and governments. In the case of the one country most at risk for energy security, Maplecroft found that:

Sierra Leone emerged from a decade of civil war in 2002 and despitereconstruction efforts and recent economic growth, it is the worst performing country in the Energy Security Index (short term). Sierra Leone was also categorized as extreme risk in the 2011 Energy Security Index (short term). Nearly 10 years after the end of the war only 10% of the country’s population has access to electricity and the supply is erratic and limited to major towns. This highlights the lasting effect that conflict can have on the energy security and infrastructure in vulnerable nations.

But these West African countries are not the only ones at risk for energy security.

Most of the G-7 nations are included in the short-term “high risk” category, including Italy, Japan, UK, Germany, France and the USA.

The world’s second largest consumer of energy, the USA, rates as ‘high risk’ in the short-term, primarily because of the high imports of fossil fuels and electricity needed to support its colossal demand for energy. The largest percentage of US oil imports come from Middle Eastern countries – leaving the country at continual high risk of supply interruption and price shocks.

buy finasteride online cosmeticdentistrywilton.com/wp-content/uploads/2023/10/jpg/finasteride.html no prescription pharmacyIn 2008, the US imported an average of 12.9 million barrels of oil per day, which represents 15.10% of world production in that year, with 23.36% coming from the MENA region.

Canada is the only G-7 nation rated as “low risk,” most likely because of the country’s abundant energy production and exporting business, coupled with its wealth of energy expertise, science and technology.

Japan’s ranking as “high risk” was due to many factors, including the earthquake and tsunami in March, which severely damaged the country’s ability to generate energy.

There is a silver lining, however, as Prime Minister Naoto Kan recently unveiled plans to bring down the cost of solar power generation by 2010 and to install solar panels in 10 million Japanese homes.