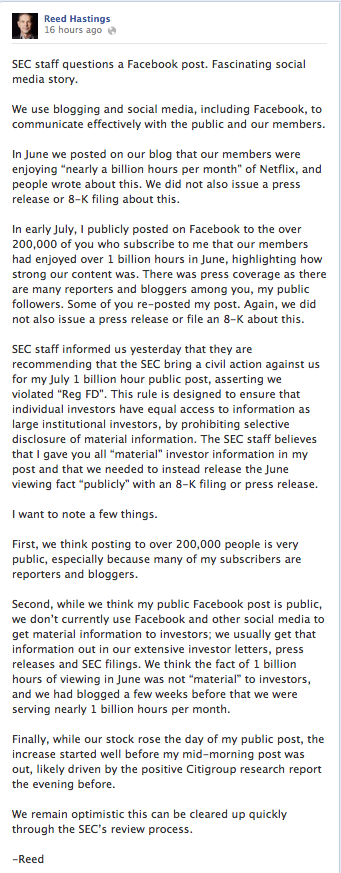

In each issue of Risk Management, we publish book reviews from the staff. Some books are easily forgettable, while others make us stop and think. They inspire us, teach us and may even end up on our bookshelves at home. The following are our picks for best business books of 2012:

The Wide Lens

The Wide Lens

When it comes to innovation, common sense dictates that if you develop a great product it will be successful. But history is littered with great products that never quite made it, from electric cars to inhalable insulin to any e-reader that came out before the Kindle. So why do some great innovations succeed while others fail? According to author Ron Adner in his book The Wide Lens, the reason doesn’t lie with the innovation itself. Instead, many companies overlook two important risks while taking an innovation from concept to reality, and these blind spots can doom the product before it even gets out of the gate.

Street Freak

Street Freak

Expensive scotch, $3,000 dinners, 80-hour workweeks, million-dollar trades, million-dollar paychecks and acute psychosis. It’s the life of a big bank trader. Or, at least it was for Jared Dillian, a Lehman Brothers index arbitrage trader from 2001 to 2008. In his energized memoir, Street Freak, Dillian recounts his days at what used to be one of the largest banks in the world, from his time as an associate assigned to work security when Lehman relocated to Jersey City after 9/11 to his rise to the firm’s head exchange-traded fund trader. In between were massive highs and lows, and a realization that Dillian was afflicted with bipolar and obsessive-compulsive disorders, conditions that almost cost him his life.

Learning from the Octopus

Learning from the Octopus

Since 9/11, the concept of national security has changed. The United States has not been attacked by terrorists since that day, so something must be working, but the general approach has been fundamentally flawed, according University of Arizona marine ecologist Rafe Sagarin in his new book Learning from the Octopus. To Sagarin, the general mentality to fight a “war on terrorism” — a war with a broad, reactionary strategy that can never be won—is misguided. “Fish don’t try to turn sharks into vegetarians,” writes Sagarin. “Living immersed in a world of constant risk forces the fish to develop multiple ways to live with risk, rather than try to eliminate it.”

Consent of the Networked

Consent of the Networked

Many social uprisings in emerging countries have gained momentum via the internet. From the first, in Tunisia in 2002, to the 2011 ouster of Egyptian dictator Hosni Mubarak, an internet revolution has provided a platform for those without a voice. The power of the web to change history and turn political strife to personal freedom is documented with great detail in Consent of the Networked. But the internet’s power can also spread evil. Author Rebecca MacKinnon, a journalist and former CNN bureau chief in Beijing and Tokyo, uses China as one example. In possibly the best chapter in the book, the author details how Chinese internet crusaders are using the web to fight against, among other things, injustice within the legal system. “The internet enables ordinary Chinese people to speak truth to power and pursue justice in unprecedented ways,” writes MacKinnon. “At the same time, Chinese internet users have a manipulated and distorted view of their own country as well as the broader world.”

Into the Storm

Into the Storm

The Sydney to Hobart Yacht Race is considered one of the most prestigious and difficult open water races in the world. Covering 628 nautical miles from Sydney, Australia, to Hobart, Tasmania, the race is known for challenging ocean conditions, blustery winds and frigid temperatures that can test even the most experienced sailors. Into the Storm tells the gripping story of how one of the smaller boats in the competition, the AFR Midnight Rambler, not only survived the race, but went on to win the prized Tattersall’s Cup, which is awarded to the winner. In the process, author Dennis Perkins, who also recounted Ernest Shackleton’s Antarctic expedition in Leading at the Edge, shares interesting lessons about the power of teamwork under the most extreme conditions.