Growing populations around the globe have created larger cities, as well as greater concentrations of risk. It is projected that a rise in sea levels and increased intensity of events will amplify the impact of hurricanes, tornadoes, heat waves, floods and droughts. Because of this, climate change is seen as one of the biggest threats to cities and businesses and could account for an estimated 20% of the global GDP by the end of this century, according to “Business Unusual: Why the climate is changing the rules for our cities and SMEs” by AXA.

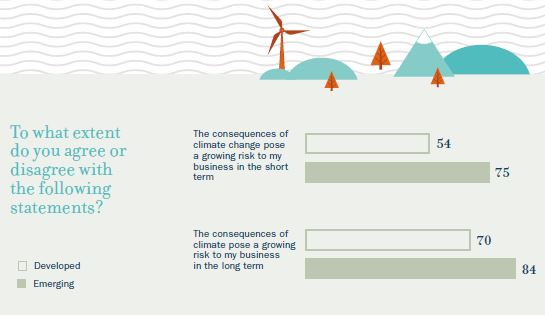

While some cities have worked to put resilience plans in place to reduce the impact of flooding and other disasters, there is much to be done and businesses are vulnerable, especially small- to medium-sized enterprises (SMEs). Only 26% of SMEs have taken action to protect themselves, yet 54% are worried about the impact climate change could have on their business, and the number rises to 75% in emerging markets, the study found.

“These disasters would be magnified by the fact that populations and assets have never been so concentrated in disaster-prone areas,” Henri de Castries, chairman and CEO of AXA Group said in the report. “Half of the world’s population now resides in cities, often along coastlines, and this proportion is due to rise to nearly two-thirds by the middle of the century, representing some 6.4 billion people. It comes as little surprise, then, that 80% of the climate change adaptation costs for 2010-2050 would be borne by urban areas.”

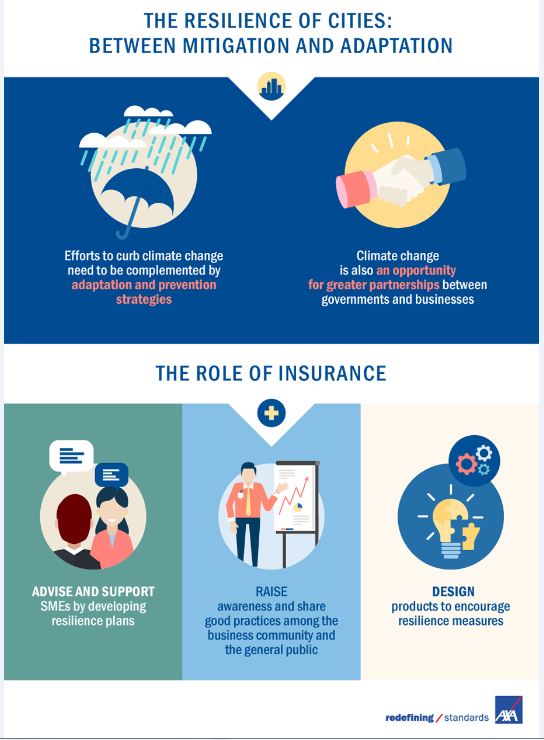

According to the report, these are common elements of resilience planning:

- Risk assessments to identify key vulnerabilities.

- Adaptation of essential infrastructure to withstand changes to the environment.

- Development of flood defenses to protect inhabited areas from flooding caused by extreme weather events and increased rainfall.

- Urban planning and relocation of buildings, including adapting to future developments that allow greater resilience to the consequences of climate change.

- Development of emergency warning and response plans—emergency response planning is a core pillar of resilience strategy.

- Community engagement and awareness-raising activities.

Additional findings: