Last week’s crane collapse in Lower Manhattan, which killed one person and injured three others, has heightened focus on crane safety, resulting in stricter rules for operators. The 565-foot crane toppled as it was being secured against high winds as a safety precaution.

More than 140 firefighters responded to the disaster in addition to police officers and utility workers who were there in case of gas leaks or other damage caused by the impact.

Mayor Bill de Blasio called for an investigation and instituted new safety policies effective immediately, while ordering that 376 other crawler cranes and 53 larger tower cranes currently operating in the city also be secured. The new rules require crawler cranes to cease operations and go into safety mode when there is a forecast for steady wind speeds of at least 20 miles per hour, or gusts of at least 30 m.p.h. Previously, cranes were allowed to operate until measured wind speeds reached 30 m.p.h. or gusts increased to 40 m.p.h.

“I want people to hear me loud and clear: We’ve had some construction site incidents that are very troubling,” de Blasio said at a news conference. “We have more and more inspectors who are going to get on top of that. We’re going to be very tough on those companies.”

He added, “We’ll send advisories to crane engineers when wind conditions warrant it, and engineers will be required to certify that they will indeed cease operations. If we don’t receive this certification, we will be issuing violations and we will raise the base penalty for failure to safeguard a site from the current $4,800 to $10,000.”

While construction in the city has increased over the past two years, the New York Times reported that the rise in deaths and injuries has exceeded the rate of new construction, that supervision at building sites was often lacking, and that preventative safety steps were not being taken.

Indeed, the list of incidents involving cranes has grown to eight since 2008, according to ABC News and the Associated Press.

— March 2008: A nearly 200-foot-tall crane fell as it was being lengthened in a neighborhood near the U.N. headquarters, demolishing a townhouse and killing six construction workers and a tourist. The crane rigger was tried and acquitted of manslaughter. An inspector accused of falsely saying he had checked the crane days before it toppled was acquitted of charges related to the collapse but convicted of falsifying inspection records related to other cranes.

— May 2008: A tower crane snapped, fell apart and crashed into a Manhattan apartment building, killing the crane operator and a construction worker on the ground. The crane owner was acquitted of manslaughter. A mechanic pleaded guilty to criminally negligent homicide. Together, the 2008 collapses prompted the resignation of the city buildings commissioner and a bribery case in which the city’s chief crane inspector pleaded guilty to taking payoffs to fake inspection and licensing exam results. The collapses also led to new safety measures, including hiring more inspectors and expanding training requirements and inspection checklists.

However, Comptroller Scott Stringer said in a 2014 audit that the city Department of Buildings hadn’t fully implemented safety recommendations on cranes and other issues, and Stringer reiterated his concerns Friday. The Department of Buildings disputed some of the audit’s conclusions, but spokesman Joe Soldevere said the agency had implemented many of the comptroller’s recommendations and “there is more oversight of cranes in place than ever before.”

— October 2012: A crane’s boom nearly snapped off and dangled precariously over a block near Carnegie Hall during Superstorm Sandy, as winds gusted to an estimated 80 to 100 mph. No one was injured, but people in a nearby hotel and other neighboring buildings had to flee in the midst of the storm as engineers scaled 74 stories to make sure the crane wasn’t in danger of falling.

— April 2012: A mobile crane’s boom fell and broke apart while hauling rebar at a subway station construction site, killing a worker. The site was exempt from most city construction safety rules because it belonged to a state transit authority.

— January 2013: A crane’s 170-foot-long boom fell and pulled down part of the wooden framework of an apartment tower under construction in Queens, injuring seven workers. Three workers had to be extricated from beneath fallen machinery.

— April 2015: Hydraulics malfunctioned on a small crane mounted on a truck while a worker was inspecting it in Manhattan, causing the boom to collapse and fall on him, killing him. The device wasn’t subject to the same regulations and inspections as larger cranes.

— May 2015: A mobile crane dropped a 13-ton air conditioning unit being placed atop a Manhattan office building. The air conditioning equipment fell 28 stories into the middle of an avenue. Ten people were injured by debris, and part of the building facade was shattered.

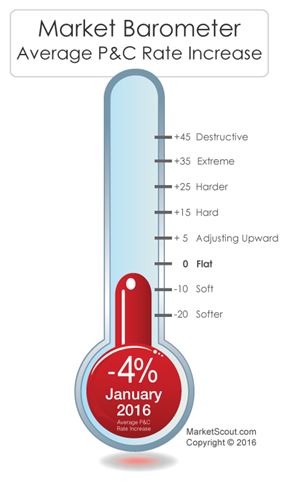

prevent commercial property rates from dropping further.”

prevent commercial property rates from dropping further.”