With Oct. 1 just days away, it’s that time of the year, when deer, elk and moose become more active in the United States, increasing the risk of collisions. In fact, the risk of hitting one of these large animals doubles during the months of October, November and December, according to State Farm.

December, according to State Farm.

This is no small matter, as these accidents can cause significant injury and damage. In fact, the average cost per claim nationally for 2015-2016 was ,995.

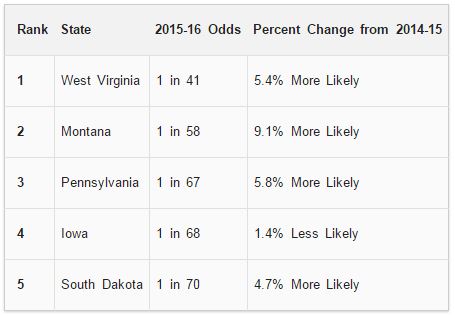

08, down slightly from $4,135 in 2014-2015. In its annual ranking, State Farm identifies the state where a driver is most likely to have a claim from a deer, elk or moose collision as West Virginia, where the odds are 1 in 41.

The state where such a collision is least likely (excluding Hawaii) is Arizona, where odds of getting into such an accident are 1 in 1,175.

buy wellbutrin online https://galenapharm.com/pharmacy/wellbutrin.html no prescription

“We know there is an increased risk of collision with deer around dawn and dusk, and also during the October-December breeding season,” Chris Mullen, director of technology research at State Farm said in a statement. “However, drivers should be engaged, alert and on the lookout at all times, because you never know when you may need to react to a deer or any other obstacle that may suddenly be in your path.”

In its 2015-2016 study, State Farm found that the top five states where a driver is most likely to have a claim from a collision with a deer, elk or moose are:

Safety tips for drivers:

- Slow down, particularly at dusk and dawn

- If you see one deer, be prepared for more to cross the road

- Pay attention to deer crossing signs

- Always buckle up, every trip, every time

- Use your high-beams to see farther, except when there is oncoming traffic

- Brake if you can, but avoid swerving, which could result in a more severe crash

- Remain focused on the road, scanning for hazards, including animals

- Avoid distractions, like devices or eating, which could cause you to miss seeing an animal

- Do not rely on products such as deer whistles, which are not proven effective

- If riding a motorcycle, always wear protective gear and stay focused on the road ahead.