In a new RIMS Professional Report, attorneys Mark Plumer and Xandra Bernardo (of Pillsbury Winthrop Shaw Pittman LLP) and Patrick Walker, a risk professional at mining company Rio Tinto Group, shed light on the top risk management legal developments of 2017.

According to the authors, risk managers “must be familiar with the legal principles that underlie claims that are asserted. A successful resolution will turn on the policy wording, the company’s business relationship with the affected insurers and the strength of the  coverage argument under the law.”

coverage argument under the law.”

In The Top 8 Legal Developments You Need to Know About in 2017, the authors lay out the notable rulings on insurance law relating to rights of coverage, rescission, cyber coverage and more. Here is a quick look at their findings:

- Rights to Coverage: There were important developments to rights of coverage under historic occurrence-based policies. These relate to “long-tail” liabilities such as environmental exposures.

“The best practice now is to assign the right to make claims on historic policies for such exposures, where such transfer of rights is intended. Legal counsel should assure that the law in the affected jurisdictions allows for the transfer of insurance rights.”

- Rescission: It’s an insured’s worst nightmare: you have a claim that you believe should be covered, and the insurance company finds a way to rescind coverage. It’s a growing trend. “In particular, insurers are requiring more disclosures during the application process and may seek rescission if full and accurate disclosures are not provided.”

The authors focus on H.J. Heinz Co. v. Starr Surplus Lines Ins., a trial decision that was reached in New York’s Third Circuit. The court ruled that Heinz was not entitled to its purchased coverage because of historic loss information that was mistakenly withheld by the company’s risk manager.

“The Heinz case highlights the importance of answering questions thoroughly and truthfully in connection with applying for insurance. Applying for insurance is an increasingly challenging process, particularly with respect to specialty policies that require answers to many questions and call for considerable data. Risk managers must assume that insurers will be emboldened by Heinz and other, similar cases.”

- Consent to Settle: In case you needed to be reminded: risk management and corporate counsel need to work together!

“Some courts may simply void coverage where there is a voluntary payments provision and advance consent from an insurer for a settlement was not requested regardless of whether the insurer was prejudiced.

It is rare that insurers will stand in the way of a settlement. Thus, asking for consent often is no more than a technical requirement. Insurers should not be allowed to escape coverage your company has paid for based on a technicality.”

- Notice: Your coverage can be voided if you don’t give prompt notice of a claim. There were two important developments on this front in 2017 that the authors describe in detail in the report.

“The best way to avoid an insurer ‘late’ notice argument is to provide notice at the earliest reasonable date, even if this requires later supplementation and clarification. Of course, this is often easier said than done. You should learn the law affecting notice in your home jurisdiction and consider treating occurrence-based policy and claims-made policy notification procedures differently…”

- Cyber Claims: This is obviously a hot area in risk management and in insurance. It seems like we constantly hear about new entrants into the insurance market on this front, with new firms specializing in cyber also popping up almost every day. Risk managers need to exercise caution in this field: cyber insurance is still relatively new and untested, and the claims history for this subfield is short.

buy desyrel online www.dino-dds.com/wp-content/uploads/2023/10/desyrel.html no prescription pharmacy

The policies are also potentially confusing. For example, “many cyber policies specifically provide coverage for credit card association assessments for an additional premium. These policies are quite complicated and may contain dozens of cross-referenced definitions.”

- Construction Claims: The authors dive into key decisions coming out of New Jersey and Iowa on this familiar risk management topic. They caution risk managers to “make certain your CGL policy has a subcontractor exception in the ‘your work’ exclusion. Policies containing a ‘your work’ exclusion that do not also include a subcontractor exception to that exclusion place your company at greater risk.”

- Additional Insured: Access to additional insured endorsements is getting narrower, according to the authors. A decision from New York continues this trend: the June 2017 decision from New York’s high court in Burlington Ins. Co. v. NYC Transit Auth.

The report cautions that the Burlington decision “may come as a surprise to many policyholders who expect courts to interpret additional insured endorsements broadly, particularly ISO’s standard form endorsements. Risk managers concerned about this potential reduction in coverage can follow the advice of the Burlington court: ‘Of course, if the parties desire a different allocation of risk, they are free to negotiate language that serves their interests.’”

- Scope of Coverage: It’s important to understand your home jurisdiction’s philosophy on long-tail general liability claims. There are two types of jurisdictions, according to the authors: “all sums” and “pro rata.” In 2017, there were several decisions that complicated this well-understood legal dynamic.

“If your company faces a long-tail claim, be proactive and understand the scope of coverage law applicable to your historic policies. If the jurisdiction applies the ‘all sums’ principle, make sure your counsel is aware of it. If not, confirm whether your historic policies contain non-cumulation clauses or if the applicable jurisdiction has considered the ‘unavailability’ exception to pro rata allocation.

”

For more information on “all sums” versus “pro rata,” as well as detail for all of the top legal developments, please visit www.rims.org and download the paper. All RIMS papers are members-only for the first 60 days of their release.

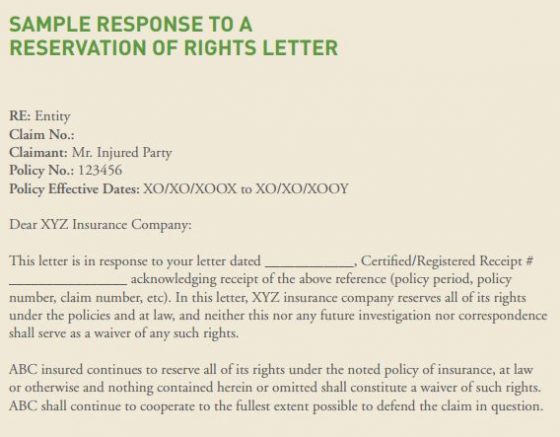

In some cases, a well thought-out response can save an organization a large amount of money. A good example is the common insurer-proposed reservation to recover defense costs spent on defending a policyholder if the insurer determines at a later date that it did not, in fact, have a responsibility to defend. In order to reject this reservation and the big legal bills that could come with it down the road, many jurisdictions in the United States require that the insured respond to the reservation of rights letter and specifically disagree with this detail.

In some cases, a well thought-out response can save an organization a large amount of money. A good example is the common insurer-proposed reservation to recover defense costs spent on defending a policyholder if the insurer determines at a later date that it did not, in fact, have a responsibility to defend. In order to reject this reservation and the big legal bills that could come with it down the road, many jurisdictions in the United States require that the insured respond to the reservation of rights letter and specifically disagree with this detail. Stand-up workstations and exercise balls used for sitting in place of an office chair are gaining popularity.

Stand-up workstations and exercise balls used for sitting in place of an office chair are gaining popularity.