Just when you think the discipline of risk management is making headway in the boardrooms of large corporations across numerous industries, a report surfaces that makes you think otherwise.

I’m referring to a research report by the Economist Intelligence Unit (EIU) titled Ascending the Maturity Curve: Effective Management of Enterprise Risk and Compliance.

The report compares perception with reality, exposing the discrepancies between how executives view their risk mitigation capabilities and what they are actually doing.

online pharmacy flagyl with best prices today in the USAThe research is based on a worldwide survey of 385 senior executives from the finance, risk, compliance and legal functions, and a series of in-depth interviews with executives familiar with risk and compliance within their organizations.

Some of the key findings from the report:

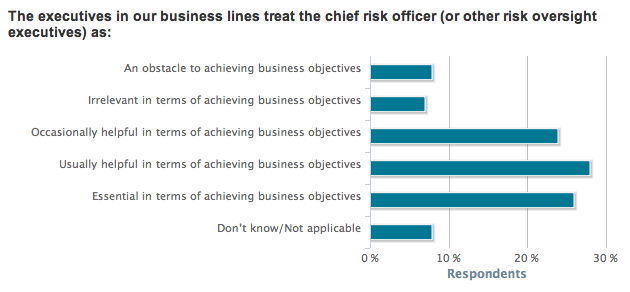

1. Chief risk officers are not earning the respect they should

The appointment of a CRO has become more common in companies after the Basel Accord and Sarbanes-Oxley, and even more so after this latest recession. Though the awareness of CROs and their functions has been on the rise, their contributions are not recognized as they should be. Surprisingly, the EIU research finds that just 26% of those surveyed felt the CRO was “essential in terms of achieving business goals.”

2. Finance executives remain unaware of risks

According to the survey, “Compared to colleagues in legal, risk and compliance functions, finance professionals are far more likely to say that their organizations haven’t suffered from significant risk or compliance failures.” This is yet another surprising finding since the financial department is considered one of, if not the, most important department in an organization, considered the oxygen to the life of a company. If they are operating with the mindset that their company is perfect, either they’re not being true to themselves or they honestly cannot see failures. Both scenarios are scary.

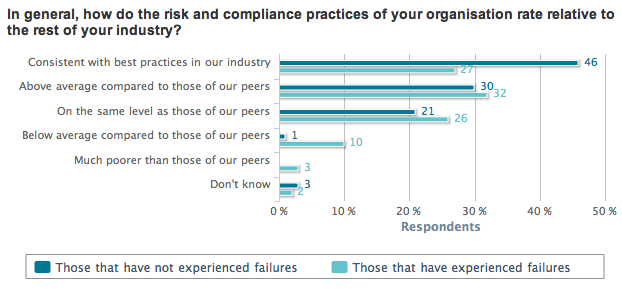

3. Most executives wrongly assume they’re earning an “A”

It could be seen as confidence overload among top executives — almost half of those surveyed said their company’s practices are consistent with the best in the industry. The EIU references the Lake Woebegone effect — or when the vast majority of people think they’re above average.

This is never a good attitude to have when practicing risk management, a discipline which, among other things, means thinking of everything that could go wrong, will, and working on a plan to mitigate such risks. Over-confidence is never a good attribute for risk management.

The report also covers the lack of consistent policies on business practices, learning from failures, knowing a company’s risk appetite and which two functions are most averse to risk.

Though not a very optimistic report, we must not let such research bring us down. Rather, we should use them for insight, instruction and inspiration.