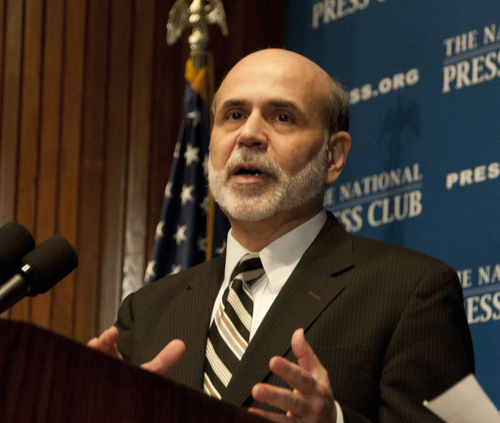

Fed Chairman Ben Bernanke is calling for stricter risk management of financial clearing houses. During a recent speech in Stone Mountain, Georgia, he stated how important these clearing houses are and how important it is to protect them from systemic risks. And important may be a bit of an understatement.

Basically, when a financial transaction is processed (common stock, futures, options, etc.) either in an exchange or over the counter (OTC), the trade is handed over to a clearing house, which assumes the legal counterparty risk for the trade. Basically, the clearinghouse makes sure both parties involved in the trade make good on their agreement. And if one does not, it absorbs that risk. It goes to say that clearing houses take on A LOT of risk, especially considering the chances of a large firm defaulting or a market crash.

Worrisome to Bernanke, and others I’m sure, is the concentration of such risks among only a few organizations, the most popular being the Depository Trust & Clearing Corporation and Fedwire. Realizing the importance of these firms for day-to-day financial transactions, he called for actions to ensure the safety of these intermediaries.

“Because the failure of, or loss of confidence in, a major clearinghouse would create enormous uncertainty about the status of initiated transactions and, consequently, about the financial positions of clearinghouse participants and their customers, strong risk-management at these organizations, as well as effective prudential oversight is essential,” Bernanke said.

Bernanke does point out, however, that clearing houses have withstood severe crises in the past, to which he attributes to “good planning and sound institutional structures but also some degree of good luck.”

But are clearing houses too big to fail? Will they take on unnecessary risks because that is how they view themselves? We’ve seen how that has played out before so let’s hope Bernanke’s words are put to action.

Read the full transcript of Fed Chairman Ben Bernanke’s speech at the 2011 Financial Markets Conference.