It has been proven time and time again that communication is a pivotal and essential cornerstone of business and individual professional success. Throughout business, whether in presentations to the board or chatting with co-workers around the Nespresso machine, communication can make or break a relationship. Often, the key to building that relationship is making an effort to learn another discipline’s language.

Today, no matter what industry your company may be in, executives are increasingly focusing on the technological advances that can help achieve a competitive advantage. And just as the insurance industry has its own unique language (and a plethora of acronyms—don’t get me started on that), so too does the digital world. If risk managers want to continue rising in the executive ranks, we will need to get on the same page as the technological innovators changing our world. That means learning to speak digital.

You don’t have to be a developer or coder to have a tech-based discussion. But, you do need to make the effort to understand some key terms and concepts in order to successfully communicate, particularly within your organization.

You can start simply—find a colleague in your IT group to help bridge the language gap. It can not only help you understand the tech world, but it can also allow others to better understand yours.

Call it a beneficial opportunity for mutual mentoring.

In my own experience over the past year working with insurtech start-ups, I have found the tech community to be extremely open and receptive, regardless of whether you are speaking with the CEO, co-founder, data scientist or developer.

It can be daunting at first. When I was first asked to review wireframes (website structural plans) or user story mapping (outlines of website visitor behavior) or when they said they’ll “Slack me” (contact me via the popular messaging and file-sharing app Slack), I have to admit, there was a bit of Googling involved. But, what I have found is that they are just as eager to learn about the risk management world as much as they are to impart knowledge and understanding about the technology ecosystem.

If you are still somewhat intimidated about diving into the deep end at the office, get your feet wet by starting small. Read an article on a technology that may resonate with your company’s strategy, current business plan or operational initiative. Attend an industry event that has insurtech or risktech (or whatever-tech) on the agenda. There are events in every geographical jurisdiction from formalized conferences to social meet-ups. If you can’t find one in your backyard, webinars and podcasts are also great resources.

No matter what, it is important to take that first step. It may be scary or uncomfortable, but that’s a good thing.

You will soon find yourself wading outside of your comfort zone, which means you will be growing professionally and will be on your way to learning that new language.

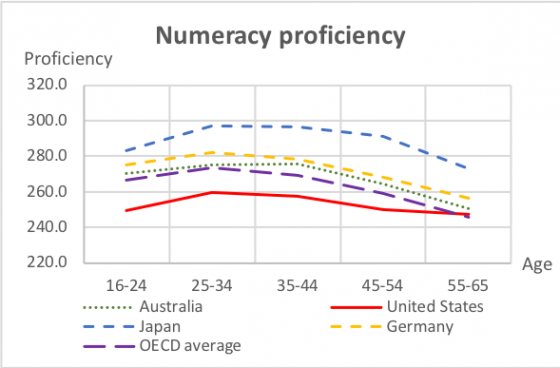

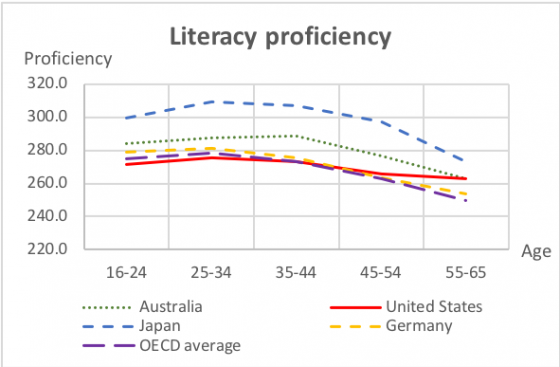

People are living and working longer today than in the agricultural and industrial ages. The growth in the number and percentage of individuals over 60 and 80 years of age is already having a global impact.

People are living and working longer today than in the agricultural and industrial ages. The growth in the number and percentage of individuals over 60 and 80 years of age is already having a global impact.

Cassandra R. Cole, Department Chair of Risk Management Insurance, Real Estate, and Legal Studies at Florida State University; Director of the Master of Science in RiskManagement and Insurance Program and the William T. Hold Professor in Risk Management and Insurance.

Cassandra R. Cole, Department Chair of Risk Management Insurance, Real Estate, and Legal Studies at Florida State University; Director of the Master of Science in RiskManagement and Insurance Program and the William T. Hold Professor in Risk Management and Insurance. Soraya Wright, founder and CEO of SMW Risk Management Consulting and also a member of the

Soraya Wright, founder and CEO of SMW Risk Management Consulting and also a member of the