DailyFinance.com is projecting that the recent 8.8 magnitude earthquake in Chile could cause insured losses anywhere from billion to more than billion.

The quake struck February 27th and is now believed to be one of the top 10 most powerful earthquakes ever.

Catastrophe modeling company EQECAT Inc. said insured damages from the quake could range from $3 billion to $8 billion, with economic losses ranging from $15 billion to $30 billion. Economic losses will continue to be updated as the ongoing assessment of infrastructure damage is confirmed. The company also said the speed of restoration of the transportation and utility networks will also determine the total amount of business interruption losses claimed.

Effects of the earthquake stretched from 115 miles north of the industrial city of Concepcion to the capital of Santiago — more than 325 miles away from the epicenter.

“AIR Worldwide estimates that the value of insurable buildings in the quake zone is $275 billion, but very few of the structures are likely to have been insured. The company said that as little as 10% of residential buildings are believed to have been insured and about 60% of the commercial structures were insured.”

The Haitian earthquake and Chilean earthquake differ drastically in terms of insurance. Though the earthquake that struck Chile was approximately 500 times as powerful as the one that struck Haiti, Chile will recover more quickly because of it’s highly developed insurance market. In an article release today, Robert Hartwig, president of the Insurance Information Institute (I.I.I.) said that “in addition to a number of Chilean insurers, many large international insurers and reinsurers—mainly American and European—compete for business in that country, and will provide the financial resources for Chile’s reconstruction.” He contrasted the situation to that in Haiti, an area that Hartwig said has almost no private insurance market.

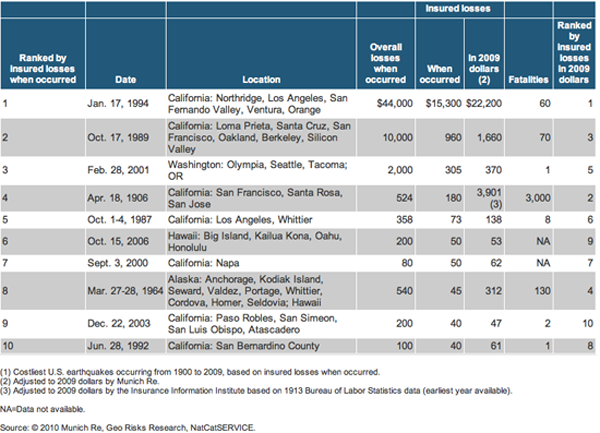

The I.I.I. shows the following table, titled the “10 most costly U.S. earthquakes (in millions).”

In the March issue of Risk Management, our editor, Jared Wade, takes an in-depth look at the catastrophe in Haiti and the future of natural disasters. A good read, I must say.