PHILADELPHIA–Disruptive technologies are used more and more by businesses, but those organizations appear to be unprepared. What’s more, companies seem to lack understanding of the technologies and many are not conducting risk assessments, according to the 14th annual Excellence in Risk Management report, released at the RIMS conference here.

The study found an apparent lack of awareness among risk professionals of their company’s use of existing and emerging technologies, including the Internet of Things (IoT), telematics, sensors, smart buildings, and robotics and their associated risks. When presented with 13 common disruptive technologies, 24% of respondents said their organizations are not currently using or planning to use any of them. This is surprising, as other studies have found that more than 90% of companies are either using or evaluating IoT technology or wearable technologies and that companies in the United States invested $230 billion on IoT in 2016.

Another finding was that despite the impact disruptive technology can have on an organization’s business strategy, model, and risk profile, 60% of respondents said they do not conduct risk assessments around disruptive technologies.

“Today’s disruptive technologies will soon be — and in many cases already are — the norm for doing business,” said Brian Elowe, Marsh’s U.S. client executive leader and co-author of the report said in a statement. “Such lack of understanding and attention being paid to the risks is alarming. Organizations cannot fully realize the rewards of using today’s innovative technology if the risks are not fully understood and managed.” According to the study:

Organizations generally, and risk management professionals in particular, need to adopt a more proactive approach to educate themselves about disruptive technologies — what is already in use, what is on the horizon, and what are the risks and rewards. Forward-leaning executives are able to properly identify, assess, and diagnose disruptive technology risks and their impact on business models and strategies.

This lack of clarity presents opportunity for risk professionals. In fact, previous Excellence reports have indicated that C-suite executives and boards of directors want to know what risks loom ahead for their organizations and increasingly rely on risk professionals to provide that insight.

“As organizations adapt to innovative technologies, risk professionals have the opportunity to lead the way in developing risk management capabilities and bringing insights to bear on business strategy decisions,” said Carol Fox, vice president of strategic initiatives for RIMS and co-author of the report. “As a first step, risk professionals are advised to proactively educate themselves about disruptive technologies, including what is already in use at their organizations, what technologies may be on the horizon, and the respective risks and rewards of using such technology.”

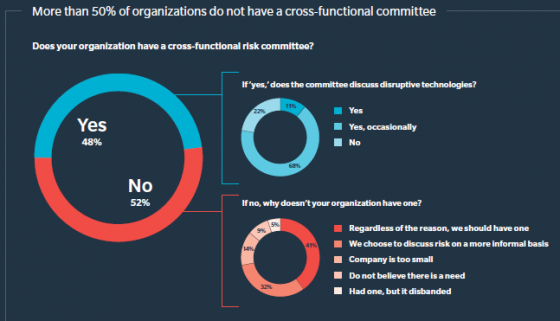

One thing companies can do to manage risks associated with disruptive technologies is facilitate discussions through cross-functional committees—yet fewer companies, only 48%, said they have one, a drop from 52% last year and 62% five years ago.

Whether discussed in weekly, monthly, or quarterly organization-wide committee meetings, emerging risks — including disruptive technologies — need to be examined regularly to anticipate and manage the acceleration of business model changes. When risk is siloed, too often the tendency can be toward an insurance-focused approach to risk transfer rather than an enterprise approach that may lead to pursuing untapped opportunities.

The Excellence survey, Ready or Not, Disruption is Here, is based on more than 700 responses to an online survey and a series of focus groups with leading risk executives in January and February 2017.

Findings from the survey were released today at the RIMS 2017 Annual Conference & Exhibition. Copies of the survey are available on www.marsh.com<http://www.marsh.com> and www.rims.org<http://www.rims.org>.