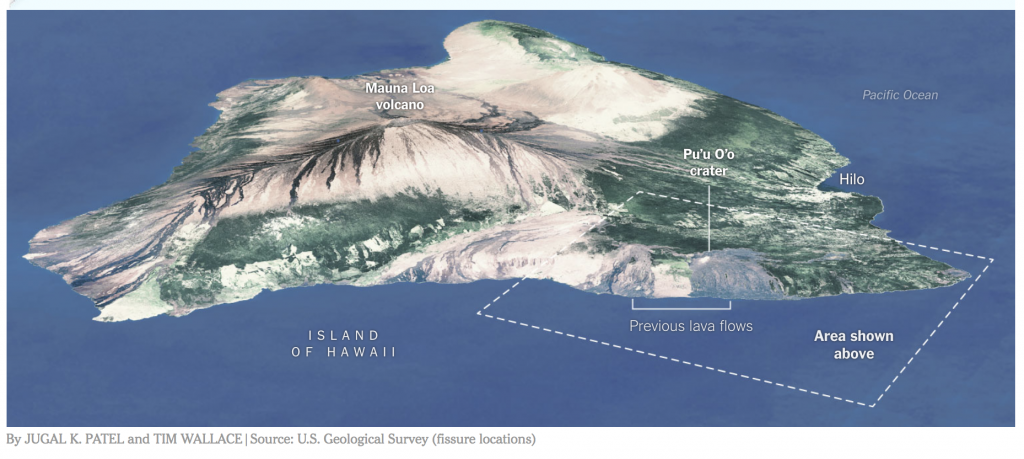

Volcanic activity from the Kilauea eruption in Hawaii has lessened, although aftershocks, lava flow and hazardous fumes continue in some areas, the Hawaii Volcano Observatory reported yesterday. Aftershocks from Friday’s magnitude-6.9 earthquake also continue, with more expected, including larger aftershocks potentially producing rockfalls and associated ash clouds, according to the United States Geological Survey.

Volcanic activity from the Kilauea eruption in Hawaii has lessened, although aftershocks, lava flow and hazardous fumes continue in some areas, the Hawaii Volcano Observatory reported yesterday. Aftershocks from Friday’s magnitude-6.9 earthquake also continue, with more expected, including larger aftershocks potentially producing rockfalls and associated ash clouds, according to the United States Geological Survey.

So far 12 fissures have emerged, sending lava into the Leilani Estates and Lanipuna Gardens subdivisions, where 35 structures have been destroyed, according to the Hawaii County Civil Defense Agency. About 1,800 people live in the area, which was ordered to be evacuated last week by Hawaii County. No deaths or injuries have been reported.

Authorities began allowing residents of Leilani Estates to retrieve their belongings on Sunday, while Lanipuna Gardens remained closed because of dangerous volcanic gases. The civil defense agency had previously warned about the threat of high levels of deadly sulfur dioxide gas in the area—released from magma no longer contained by the earth’s pressure.

According to Munich Re, about 550 volcanoes are classed as being active worldwide, with between 50 and 65 of them erupting annually. Active volcanoes in the United States are found mainly in Hawaii, Alaska, and the Pacific Northwest. The 1980 eruption of Mount St. Helens in Washington state demonstrated the disaster potential of volcanoes, causing an estimated $31 million in insured losses. The eruption killed 57 people and left dramatic changes to the landscape.

The Insurance Information Institute lists the damages caused by volcanos which are, and are not, covered by insurance:

What is covered

- Most home, renters and business insurance policies provide coverage for property loss caused by volcanic eruption when it is the result of a volcanic blast, airborne shockwaves, ash, dust or lava flow. Fire or explosion resulting from volcanic eruption also is covered.

- Homeowners and business owners’ policies also provide coverage for property damage, vandalism or theft due to looting if the occupants are displaced.

- There is typically a 72-hour waiting period before business interruption coverage kicks in.

buy lariam online cphia2023.com/wp-content/uploads/2023/08/jpg/lariam.html no prescription pharmacy

- Damage to vehicles caused by lava flow is covered under your auto insurance policy if you have comprehensive coverage, which is optional. Direct, sudden damage to engines from volcanic ash or dust is also covered under most policies.

What is not covered

- Most home, renters and business insurance policies do not cover damage from earthquake, land tremors, landslide, mudflow or other earth movements regardless of whether or not the quake is caused by or causes a volcanic eruption. Earthquake insurance is available from private insurers as an endorsement to a homeowners policy, and in California from the California Earthquake Authority, a privately funded, publicly managed organization.

- Damage to land, trees, shrubs, lawns, property in the open or open sheds (or the contents of those sheds) is typically not covered.

- The cost to remove ash from personal property is generally not covered unless the ash first causes direct physical loss to personal property. There is also no coverage to remove ash from the surrounding land.

- Business interruption insurance does not kick in unless you have an endorsement to your business owners policy for earthquake and volcanic eruption and:

- there is direct physical damage resulting in suspended operations;

- there is physical damage to other property that prevents customers or employees from gaining access to the business;

- the government shuts down the area, preventing customers or employees from gaining access to the premises.

- The damage that occurs to homes, businesses or vehicles over time due to volcanic dust is not covered under most policies.

Volcanic effusion (i.e. volcanic water and mud) is not covered under a typical homeowners, renters or business insurance policy. However, it is covered by flood insurance, available through the National Flood Insurance Program.

On a recent list of the fastest growing American cities, Nashville jumped from 20th to 7th in a year. There are more than 210 active construction projects in the downtown core alone. We are hardly alone. Denver, New York, Charlotte, Atlanta and more are experiencing similar growth. Cities are booming and growing, and the construction cycle is showing little sign of letting up soon.

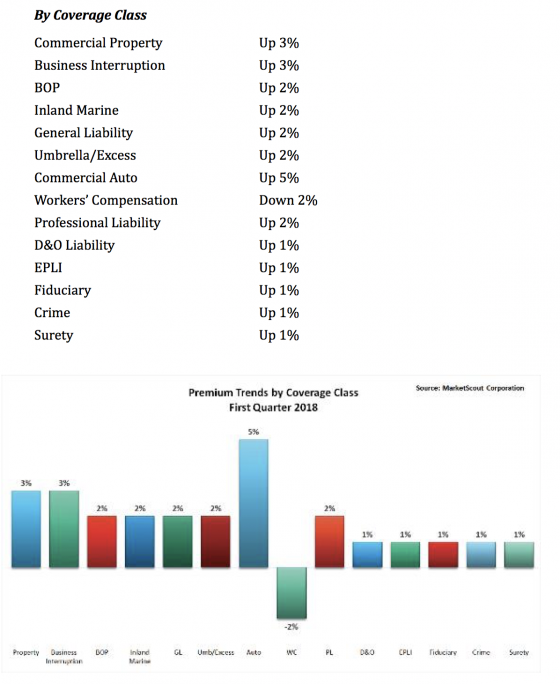

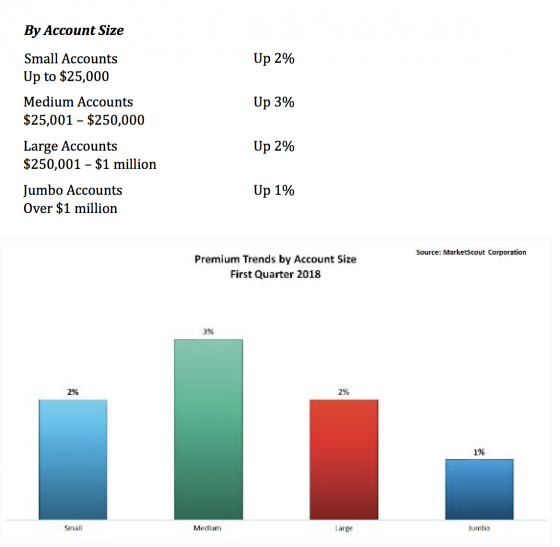

On a recent list of the fastest growing American cities, Nashville jumped from 20th to 7th in a year. There are more than 210 active construction projects in the downtown core alone. We are hardly alone. Denver, New York, Charlotte, Atlanta and more are experiencing similar growth. Cities are booming and growing, and the construction cycle is showing little sign of letting up soon. By account size, rates for medium accounts ($25,001 to $250,000 premium) increased from plus 2% in the final quarter of 2017 to plus 3% in the first quarter of 2018.

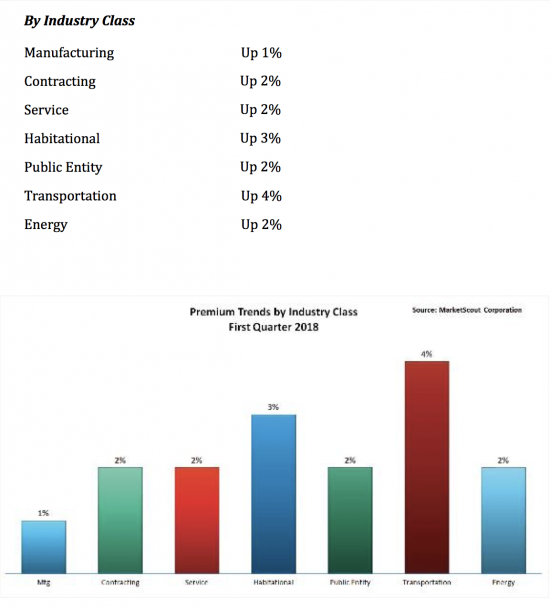

By account size, rates for medium accounts ($25,001 to $250,000 premium) increased from plus 2% in the final quarter of 2017 to plus 3% in the first quarter of 2018. By industry group, service contractors, public entities, and energy accounts were assessed larger rate increases in the first quarter of 2018 than in last quarter of 2017. Transportation accounts had a quarter-over-quarter price decrease from plus 5 to plus 4%.

By industry group, service contractors, public entities, and energy accounts were assessed larger rate increases in the first quarter of 2018 than in last quarter of 2017. Transportation accounts had a quarter-over-quarter price decrease from plus 5 to plus 4%. Richard Kerr, chief executive officer of MarketScout noted, “Automobile and transportation exposures continued to experience the greatest rate increases due to increasing expenses and adverse claim development. Insurers are struggling with this segment of our industry. Part of the problem is actual underwriting results, part is expense ratios, and in our view, a larger part is the uncertainty of the long-term prospects for the auto insurance industry.”

Richard Kerr, chief executive officer of MarketScout noted, “Automobile and transportation exposures continued to experience the greatest rate increases due to increasing expenses and adverse claim development. Insurers are struggling with this segment of our industry. Part of the problem is actual underwriting results, part is expense ratios, and in our view, a larger part is the uncertainty of the long-term prospects for the auto insurance industry.”